International Financing and Currency/Cyber-Currency Issues

Shermin Kruse

The Basics of Debt and Equity Financing

Businesses require funds to finance the support or the expansion of their operations. At times, such funds could be rather substantial. Funds can be raised via a variety of mechanisms. For example, the company can divert its revenues for this purpose, assuming the net income exceeds the amount of dividends. However, if the company is not able or interested in obtaining funds through this mechanism, they consider either equity financing, debt financing, or some hybrid between the two forms. Equity financing is essentially an ownership stake in the company. It provides the shareholder with a claim on future earnings, but there is no repayment requirement, unlike a loan. Debt financing, on the other hand, is the company raising capital through issuing debt. Issuing debt comes with the obligation to repay the debt and make interest payments known as coupon payments. Equity and debt financing methods have many advantages and disadvantages. And, of course, one form of financing is not exclusive to the other. That is, a corporation can obtain financing through both debt and equity mechanisms, and many do.

Equity Financing:

A company can issue stock that investors will purchase, thus giving the organization funds. In other words, rather than borrowing the money needed to sustain or expand the enterprise, the company sells portions of itself to external investors. If the corporate owners take the company public, these investors can be individuals, venture capital firms, other corporations, or even the general public. Companies may prefer this form of financing to debt because there is no interest on the raised capital, allowing for more cash flow availability. In addition, sometimes investors offer more than money. They bring in experience, wisdom, and industry connections, and sometimes, their mere affiliation as an investor with the company adds credibility that advances its reputation in the marketplace. In addition, unlike debt, there is no repayment requirement, regardless of whether the business fails or succeeds.

Equity financing is not always possible. Investors will desire a good return on their investment, and so they are more likely to finance businesses in high-growth entities/industries. In addition, sometimes, potential investors require unfavorable terms that limit the powers of the original founders/owners of the company, which may be an undesired result. Many entities do not prefer to issue additional stock as this would dilute the ownership interests of existing shareholders.

Pros and Cons of Equity Financing

| Pros | Cons |

|---|---|

| No immediate loan payments to make, allows for conservation of existing capital. | Requires relinquishing some ownership of the corporation and answering to investors who expect a return on their investments. |

| Equity investors can bring more than just dollars. They can also bring their network, connections, and experience. | It is possible that equity financing could ultimately result in losing control of the business by investors who may end up owning a controlling interest, and perhaps even being ousted by those investors who may not agree with the operational decisions. |

Debt Financing:

Similar to equity financing sources, debt financing sources can include individuals or other organizations. Many companies obtain a significant component of their required funding through borrowing.

This can be a terrific option for companies because the debt and the debt-related relationship with the creditor are entirely eliminated when the debt is repaid. Unlike, for example, equity capital infusions that require permanent relationships with equity investors. These debts, of course, eventually need to be repaid with interest. In addition, the rate of interest for the debt will vary based on economic conditions and the financial health of the debtor company. Therefore, stronger companies can borrow at a lower, more favorable rate than weaker ones. In addition, the amounts paid towards the interest rate on the debt are tax-deductible; thus, portions of those payments will be recouped from the government.

Corporations must be in a position to generate sufficient cash revenue to satisfy their creditors as the debt payments come due. Note, however, that sometimes entities borrow more (new) money to satisfy their prior debts. Incurring such substantial debts can pose serious risks to an organization, the ultimate risk of which is bankruptcy. In recent decades, however, it has become more commonplace for companies to be highly leveraged in this manner.

In addition, debt financing can take a variety of forms, including short-term loans (with a one-year maturing) and longer-term loans, as well as secured (backed by a corporate asset such as inventory or equipment) or unsecured. Debt may also be financed through accounts payable (this is "trade credit"). Debt can come from banks, individuals, the government, or bond issuance. Larger entities also have the option of venture debt financing, or "venture lending," which is financing provided by specialized lenders (and banks) which supply working capital even if the company does not have positive cash flow or significant assets.

Debt can significantly increase the company's financial leverage: the entity's ability to increase reported net income by earning more money on the debt than the cost of the interest payments. As a result, careful thought should be given to whether debt financing is appropriate, and if so, how it should be structured.

Debt financing is typically the best strategy when:

- The company is a high-growth enterprise. Fast-growing companies typically need additional amounts of injected capital, and typically, debt financing is less expensive than equity financing because the interest payments for the debt are tax-deductible.

- The need is short-term. The short-term debt matures in less than one year, and if repayment is made within that time, the company does not need to list the debt as a continuing liability in its year-end reporting.

The company needs to retain control. Financing through debt does not require owners and operators of the company to relinquish control or ownership stakes.

Pros and Cons of Debt Financing

| Pros | Cons |

|---|---|

| The lender has no control over the operations of the company, and once the loan is paid off the company is free of all obligations to the lender | Debt financing requires immediate regular payments, taking away from monthly revenues/capital required to operate the business |

| Successful repayment of the debt builds the credit rating of the entity, thus clearing the way for future loans/credit | Failure to repay the debt or delayed payments can adversely affect corporate credit ratings, thus making it more difficult to obtain future financing. In addition, if the collateral was pledged for the loan, it could be lost |

Overall considerations in determining whether to finance through debt or equity include the amount of control the entity owners and operators of the entity feel comfortable relinquishing to investors, the company's confidence in its financial projections and ability to rapidly turn a profit, the speed with which the company needs the financing, and whether the company requires affiliation with more experienced persons/entities.

Other Alternatives to Regular Debt or Equity Financing:

- Mezzanine financing: These are high-interest, unsecured financing options that provide investors the opportunity to convert debt to equity if the company defaults on a loan.

- Crowdfunding: Particularly for smaller entities, crowdfunding platforms on social media can serve as a funding source.

- Credit card financing: Owners of companies can use their personal credit cards to finance their company, although the interest rates are very high.

- Savings: Funds raised from family and friends are referred to as "internal equity financing."

- Hybrid financing: Many companies use a combination of debt and equity financing in proportions that minimize their weighted average cost of capital.

Issues Unique to International Debt Financing

When multinational corporations operating in multiple jurisdictions can find themselves in need of capital infusions, their core choices are similar to smaller companies: equity or debt.

However, multinational enterprises have access to a far greater variety of debt options by virtue of their larger size and international operations.

Equity Financing

Multinational corporations benefit from the diversification of cash flows and flexibility in capital sources. For instance, a corporation operating in the US, Japan, England, and China, could issue equity in exchange for cash in New York, Tokyo, London, or Hong Kong, rather than just being limited to the US markets. Their access to overseas equity financing options allows greater flexibility in funding options.

The same is true for debt products. Selling debt can be a complicated process for these larger entities and is typically subject to strict government regulations in each country the entity operates. However, they have the option of taking debt from any country in the world. These additional choices of capital sources allow multinational companies to optimize interest rates and diversify their sources of financing. While the multinational entity can, in principle, borrow from any bank in the world or issue public equity or debt in any country, for a variety of reasons, it is typically more cost-effective to raise capital in locations where they have operations. Partly, this is because financing operations from local capital provides a natural hedge against currency risks.

International companies can issue bonds and sell commercial paper instruments. They can also raise money from private lending sources such as banks, insurance companies, hedge funds, and private equity funds, which is often faster than financing equity financing through the markets.

Because of the strong international presence of the company, it is in a position to negotiate loans or lines of credit directly with any of the domestic banks in the countries it operates. As a general matter, multinational firms have far superior access to capital markets and a lower cost of debt.

As a general matter, existing as a multinational corporation diversifies the company's cash flows across countries, thus reducing the overall company-wide impact of particular country-specific losses.

As a result, multinational companies have lower volatility than similarly situated domestic corporations, which reduces their credit risks and their cost of financing and increases their overall debt capacity. Therefore, multinational enterprises tend to pay lower spreads on bank loans. As discussed separately in this book, being a multinational entity also allows significant tax arbitrage opportunities as profits can be (and frequently are) distributed in lower-tax regimes.

Multinational enterprises also face risks, however, than similarly situated domestic firms. The risks they are exposed to include political factors and exchange rates.

A company operating in multiple countries is a "foreign" entity in at least one country, and regulatory authorities frequently discriminate against foreign firms. This is sometimes referred to as economic nationalism, a preference for the native and against the foreigner, which has a both direct and indirect economic impact on foreign entity's acquisitions and impedes international capital flows of the foreign entity.

Such economic nationalistic policies include delays by regulatory agencies which show a preference to issuing approvals for local companies first, public opposition of a particular deal in the local country which then leads to moral persuasion to deter the deal-makers, and providing financing to the rival bidders from national banks. In addition, even in cases where a multinational company is operating in a favorable regime, governments change, and there is always the possibility of a policy shift coming along with that change.

Exchange rate risks are also a unique exposure faced by multinational enterprises. By their very nature, their revenues are received in a variety of currencies, creating a mismatch between income, receivables, and liabilities as currencies fluctuate and leading to a demand for hedging foreign exchange risks.

Overall, however, multinational enterprises have a financing advantage over domestic firms. They can take advantage of capital-raising opportunities in any of the countries where operations are located, diversify funding sources, lower information asymmetry, and maintain access to foreign capital markets despite financial market disruptions in one part of the world. For instance, during the 2008 financial crisis, when capital raising became extremely difficult in Europe and the United States, Asian markets continued to function normally. Therefore, companies with Asian operations had an advantage in raising capital. This advantage makes multinational companies' income more stable, allows them to better weather country or region-specific financial storms and cycles, and permits them to optimize interest rates by providing a global lending market. Cash flows come from different countries which face different political and economic shocks, reducing the multinational company's overall cash-flow volatility. In addition, multinational entities can benefit from public governmental assistance from the governments in the countries they operate. For example, many government agencies offer subsidies to companies meeting specific requirements.

Unique Debt Financing Options for Multinational Enterprises

The two most important forms of debt finance for multinational entities are publicly traded bonds and bank debt. Multinational enterprises, however, can get a lot more creative. They can finance their growth through cross-border lending programs, supply chain finance, government-guaranteed loans, and foreign accounts receivable purchasing. Credit facilities improve cash flow, expand borrowing availability and finance long-term growth. These include revolving credit facilities (lines of credit) and term loans. But there are other forms of financing available for multinational corporations:

Trade and supply chain financing

These types of financing leverage the global network of the enterprise to mitigate the risk, reduce costs, and streamline supply chain transactions. These include:

- Trade cycle financing: The importer’s bank provides the importer’s bank with a letter of credit, or gives a business loan directly to the exporter, which works as payment until the shipment documents are presented. This can significantly reduce payment risks by accelerating payments to exporters while keeping the supply of goods active.

- Supply Chain Financing: a set of technology-based solutions that aim to lower financing costs and improve business efficiency for buyers and sellers linked in a sales transaction. SCF methodologies are technology-based solutions that automate transactions and track invoice approval and settlement. Essentially, the buyer agrees to approve their suppliers' invoices for financing by a bank or other outside financier. The short-term credit the SCF provides allows suppliers quicker access to the payment they are owed, and buyers more time to pay off their balances.

- Short-term export financing: This is a good cash flow solution for exporters. It is a process that allows the exporter (the seller) to gain working capital from an export financing company (which charges an administrative fee) in the amount of the invoice while it waits for its client (the buyer) to pay for the purchase.

Structured financing

Structured financing arrangements allow for growth opportunities while minimizing risk. They also permit multinational enterprises to extend their global reach by providing financing for non-project-related expenses. These include:

- Accounts Receivable Purchasing: Accounts receivables are unpaid invoices waiting for customers to pay (i.e. an electric company that bills its clients after the clients have received the electricity). Accounts receivable are assets equal to the outstanding balances of invoices billed to customers but not yet paid. These are recorded on balance sheets as assets. This type of financing, therefore, is a financing agreement where the company receives financing capital related to a portion of its accounts receivable.

- Medium-term export financing: This is essentially a private insurance policy which safeguards exporters against the risk of foreign buyer nonpayment. This type of instrument allows exporters to win the international sale, while reducing its own risk in the export arena.

Specialty financing

- Specialty financing, very broadly defined, is any financing activity that takes place outside the traditional banking system. Generally, firms that provide specialty financing are non-bank lenders lending to businesses which cannot otherwise obtain traditional financing.

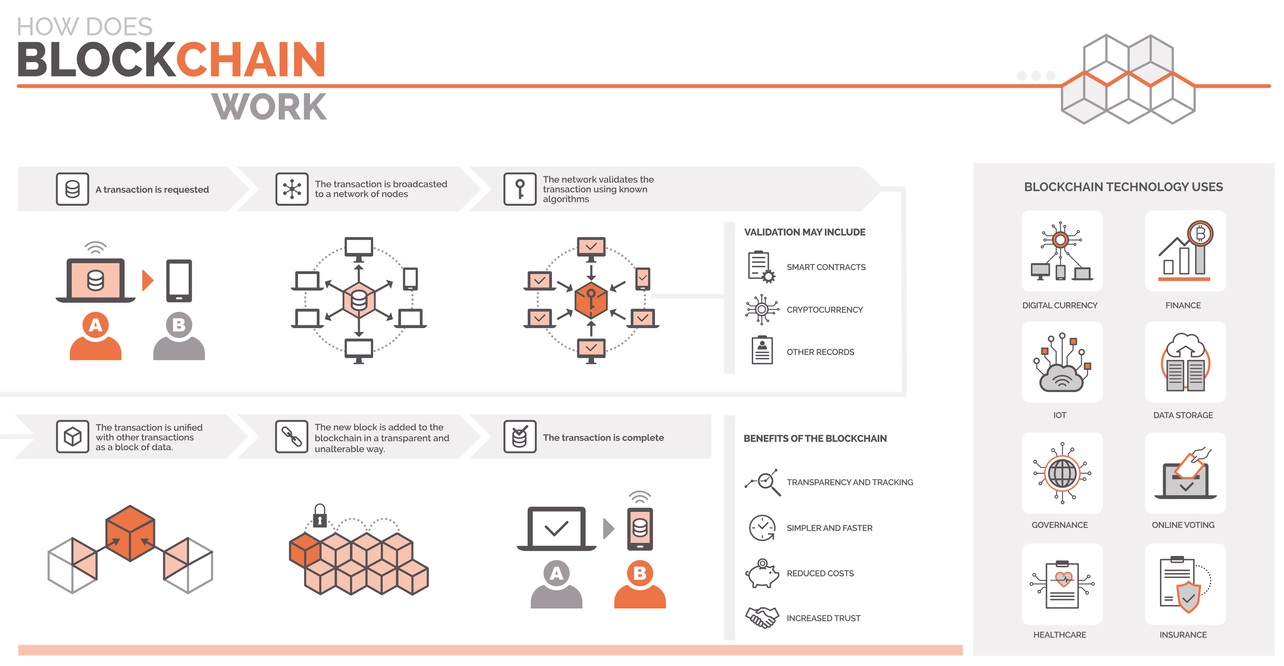

Because financing-related issues and currency-related issues overlap, it is important to spend some time understanding the most recent type of currency – that is, the crypto-currency and the functionality of blockchains. The remainder of this chapter, therefore, will be devoted to explaining the functionality of blockchains and crypto-currencies.

Block-Chains and the Red Bike

Imagine that you live in a small town with only a few hundred people – the kind of place where everyone knows everyone. Your friend, Jake, owns a unique red bike. Jake gives you the bike, so now the bike is yours. Your ownership of the bike endows it with additional unique qualities that cannot be removed. Then, two weeks later, you decide to give the unique bike that now has elements of Jake and elements of you imprinted on it, to your friend Alice. Now the bike is hers, and her ownership of the bike adds additional unique elements to the bike.

The next day, Jake sees Alice riding the red bike around town and claims it as his. Except he cannot. Because your ownership of the bike and Alice's ownership of the bike and each such accompanying transaction have imprinted themselves on the bike, like a ledger that cannot be tampered with or removed. In addition, because of the nature of your environment – the small town where everyone knows everyone – the other townspeople either saw or knew Jake gave you the bike, and that you then gave the bike to Alice.

Because of this, Jake cannot credibly reclaim that same unique red bike as his. In this way, the unique additions each transfer made to the bike and the peer-to-peer network (the townspeople) who act as the record keepers of your bike-related transactions with Jake and Alice.

This is how blockchains work. Instead of a unique red bike, one transfers cryptocurrency, and instead of the townspeople knowing the previous buyers and sellers such as Jake, Alice, or yourself by name, there is an alphanumeric public address that is known to the blockchain.

Block refers to the data of a transaction, a "chain of blocks" that contain information. The chain connects the block to both the previous and the eventual future transaction, in chronological order. The data is irreversible, making it a permanent record of information. Unlike the relationship of a bank with monetary currency such as the US Dollar, no one person or group has control over the blockchain, which allows cryptocurrency to remain decentralized while still maintaining its integrity. This is the reason blockchains are referred to as Distributed Ledger Technology ("DLT") or Peer-to-Peer Topology" ("TPP"). They are praised for the potential of eliminating the need for recording keeping while streamlining supply chains. Unlike a bank ledger, the data of a blockchain is not located on some central server. Rather, it is a distributed ledger that is stored globally on many servers; everyone on the network can see everyone else's entries in real time, just like all the townspeople can see the red-bike transactions in our hypothetical. Once the data is recorded on the blockchain, it becomes very difficult, if not impossible, to change it.

As a result, a blockchain is a digital ledger that stores all of the details of a transaction. This information, or these transaction-related records, are stored in virtual containers called "blocks." Each block contains some data, the hash of the block and the hash of the previous block. We can examine these elements one at a time.

Data

The data stored inside a block depends on the type of blockchain. In the case of Bitcoin, for example, the block would store:

- Sender

- Receiver

- Amount of coins

Hash

Each block also has a unique electronic DNA, called a "hash," which stores all of the block's content and like DNA, is always unique. Naturally, if any of the data within the block changes, the fundamental DNA of the block, or its hash, also changes.

Hash of the Previous Block

Each block contains within it not just the data for its own transaction, but also the data from the transaction before it. In this way, the blocks are all linked together sequentially – like a chain. As a result, if anyone tampers with the data within a block, thus altering its hash, the entire chain above that block will know it was tampered with because the hash those blocks store will no longer match the hash of the tampered block. The blockchain and its users – the entire global peer-to-peer network – then work to repair and undo the fraudulent alteration to the tampered block hash.

This, combined with other mechanisms (such as proof-of-work), ensure the security of the blockchain and the validity of the data within it far more than any other ledger ever used throughout the history of human transactions. Blockchains are, therefore, accessible by anyone, and contain data that cannot be altered, protected using cryptography, decentralized, ensure anonymity and privacy, and allow for a much faster transfer of assets at much lower transaction cost.

Cryptocurrencies

Blockchains as a concept have been available since 1991, but they were not popularized until they were adopted by “Satoshi Nakamoto” for the use of the cryptocurrency, Bitcoin. In 2008, the first original digital cryptocurrency, Bitcoin, was created by an anonymous inventor, or group of inventors, who went by the pseudonym “Satoshi Nakamoto” (Kay 2021). The actual identity or identities of Satoshi Nakamoto is unknown. The anonymity of the creator of Bitcoin is synonymous with the primary reasoning behind Bitcoin’s creation: to create a decentralized, unregulated system where buyers and sellers can remain anonymous. Unlike payments made in the US Dollar or Euro, transactions in cryptocurrency completely remove the bank and government from the equation. The decentralized composition allows cryptocurrency to exist without the control of governments or banks, thus giving its users autonomy (Reiff 2021). In its originality, cryptocurrency was mainly used in the dark web, encrypted online content and browsers that facilitate illegal activities, as a mechanism to buy and sell without a personalized trace (Bloomenthal 2022). The usage of cryptocurrency, therefore, mainly originates in criminal activity, with people being drawn to it because of its anonymity and independence from banks and central authorities. However, as of 2021, thirteen years after Bitcoin’s arrival, cryptocurrency has popularized beyond the dark web. There are today several different types of cryptocurrencies such as Litecoin, Ethereum, and Ripple XRP working their way into the mainstream (Reiff 2021). Mainstream payment applications such as PayPal and Square now enable their customers to buy and sell using certain forms of cryptocurrency, such as Bitcoin and Litecoin (Team 2021). Real estate properties, yachts, cars, clothing and cosmetic items, and even VISA gift cards can now be purchased using cryptocurrency (Paxful 2022).

So how does it work?

Cryptocurrency only exists on computers, so it is completely digitalized. Transactions are made directly between users, there is no “middleman” such as a bank (which is the point of using cryptocurrency). The transaction transfers the funds, for example, two Bitcoins or two Litecoins, from one account to another, and thus from one computer to another computer. The actual accounts are referred to as cryptocurrency wallets, and they are encrypted in code or numbers, so the personal identity of users can remain anonymous (Mearian 2019). Using a password, users sign into their cryptocurrency wallets to store, send, or sell their cryptocurrency. Even though who sent the transaction always remains anonymous, the transactions and the amounts transacted are public, which leads us to understand the concept of blockchains. Because there are no banks or government entities regulating the value, blockchains are an essential component as they ensure the integrity of cryptocurrency (Hayes 2022).

Due to the numerous different types of currencies (such as the US Dollar, Euro, British Pound, Japanese Yen and so on), standard international transactions typically involve exchange rates and fees from the bank. There is also the additional complication of the value of the recipient’s local currency versus the value of the sender’s local currency, which is subject to change. In fact, one of the major challenges in international trade is dealing with currencies. In addition to user discretion and autonomy, the popularity of cryptocurrency has risen because of its ease of international transactions. Regardless of where the buyer and seller are in the world, the currency remains the same (for example 1 Bitcoin in Mexico is still 1 Bitcoin in France). Since there is no intermediary involvement, there is no transaction fee for cryptocurrency, regardless of where the buyer/seller is in the world. In addition, its instantaneous nature further facilitates international transactions. Standard sending and receiving money internationally takes hours, days, and sometimes weeks for the money to arrive in the buyer’s bank account. Cryptocurrency trade is practically instant, it eliminates the typical wait period for bank authorizations and requirements (Coin Cloud 2020).

So, why isn’t everyone using cryptocurrency instead?

The volatile and inconsistent value of cryptocurrency makes it unreliable. For example, in October 2017, the price of Bitcoin was around $5,000. Three months later, in December 2017, the price of Bitcoin was at around $19,500. A mere four months later, it crashed back down to $7,000 in April of 2018 (Edwards 2022). On March 28, 2021, the last time this author checked, the price of Bitcoin was $55,682. Compare this to the stability of the $5 bill in a consumer’s pocket. The consumer can probably be safe to assume that the relative value of that $5 will be the same around this time three years from now. Due to its volatility, the functionality and reliability of cryptocurrency are not near the stability and reliability of standard currency, like the US Dollar or Euro (Pollock 2019). This is the major hurdle that cryptocurrency is facing in its quest to become the next monetary standard.

There is also the problem of taxation. Because of cryptocurrency’s gradual rise in usage, it has become subject to some institutional pressures of imposing taxes (Baldwin 2021). Federal judges, central bankers, and regulators have differing opinions on how to categorize Bitcoin for tax purposes. In 2014, the IRS declared that digital currency is considered property, and is liable to be taxed as capital gain (Liebkind 2022). As of 2020, the IRS Form 1040 “demands that taxpayers say whether or not they own any virtual currencies” (Baldwin 2021). While there is increasingly more regulation and clarity as to how cryptocurrency is taxed, the complicated nature of the unregulated, anonymity remains an issue.

Cryptocurrency Use Example: PayPal

- In October 2020, PayPal announced that it will enable its customers to buy, hold and sell cryptocurrency directly through PayPal starting in November 2020. Given the size and popularity of PayPal, this is predicted to increase cryptocurrency’s presence in the financial world. The initial cryptocurrencies available through PayPal will include Bitcoin, Ethereum, Bitcoin Cash, and Litecoin. According to PayPal, Venmo will soon follow suit in 2021 (PayPal acquired Venmo in 2013). PayPal plans to offer its customers educational content to promote the understanding of cryptocurrency and encourage its users to properly use it. In December 2020, PayPal’s stock price surged to an all-time high, surging 17%, since implementing Bitcoin purchases.

- "The shift to digital forms of currencies is inevitable, bringing with it clear advantages in terms of financial inclusion and access; efficiency, speed and resilience of the payments system; and the ability for governments to disburse funds to citizens quickly," - Dan Schulman, President and CEO of PayPal.

- “Bitcoin is the original decentralized finance because nobody controls its issuance. There is no one organization responsible for deciding who holds what. No one is in charge because everyone is in charge.” – James Murphy (Entrepreneur)

Bibliography

Baldwin 2021

Baldwin, William. 2021. “Guide to Cryptocurrency Tax Rules.” Forbes Magazine. https://www.forbes.com/sites/baldwin/2020/02/09/guide-to-cryptocurrency-tax-rules/?sh=46f7f1873974

Bloomenthal 2022

Bloomenthal, Andrew. 2022. “Inside the Dark Web.” Investopedia. https://www.investopedia.com/terms/d/dark-web.asp

Paxful 2022

Can You Buy with Bitcoin?: Paxful Blog." 2022. Paxful Blog | Crypto Guides & Product Updates. https://paxful.com/blog/what-can-you-buy-with-bitcoin

Coin Cloud 2020

Coin Cloud. 2020. “The Role Bitcoin Plays in International Trade.” Medium. https://coincloud.medium.com/the-role-bitcoin-plays-in-international-trade-37c7fcfdd7ed

Edwards 2022

Edwards, John. 2022. “Bitcoin’s Price History.” Investopedia. https://www.investopedia.com/articles/forex/121815/bitcoins-price-history.asp

Hayes 2022

Hayes, Adam. 2022. “Blockchain Explained.” Investopedia. https://www.investopedia.com/terms/b/blockchain.asp

Kay 2021

Kay, Grace. 2021. “The Many Alleged Identities of Bitcoin’s Mysterious Creator, Satoshi Nakamoto.” Business Insider. https://www.businessinsider.com/bitcoin-history-cryptocurrency-satoshi-nakamoto-2017-12

Liebkind 2022

Liebkind, Joe. 2022. “How Cryptocurrency Is Taxed in the U.S.” Investopedia. https://www.investopedia.com/tech/taxes-and-crypto/

Mearian 2019

Mearian, Lucas. 2019. “What's a Crypto Wallet (and How Does It Manage Digital Currency)?” Computerworld. https://www.computerworld.com/article/3389678/whats-a-crypto-wallet-and-does-it-manage-digital-currency.html

Pollock 2019

Pollock, Darryn. 2019. “Cryptocurrency Volatility: Enemy or Friend? How Can Digital Assets Be Price-Secure.” Forbes Magazine. https://www.forbes.com/sites/darrynpollock/2019/04/16/cryptocurrency-volatility-enemy-or-friend-how-can-digital-assets-be-price-secure/?sh=2f554d64183f

Reiff 2021

Reiff, Nathan. 2021. “What Are the Advantages of Paying with Bitcoin?” Investopedia. October 26. https://www.investopedia.com/ask/answers/100314/what-are-advantages-paying-bitcoin.asp

Team 2021

Team, Trefis. 2021. “How Nvidia, Square & PayPal Stocks Are Benefiting from Soaring Bitcoin Prices.” Forbes Magazine. https://www.forbes.com/sites/greatspeculations/2020/12/07/how-nvidia-square--paypal-stocks-are-benefiting-from-soaring-bitcoin-prices/?sh=2e3bf9a14c82